In recent years, India has achieved a significant milestone with its transformative journey from being a cash-dominated society to a cashless one. India’s digital payment revolution is a testament to India embracing a digital-first economy, making it a model case study to emulate in the world. Behind this revolution stands Bharat Bill Payment System. Since …

Navigating Bharat Connect: Understanding BBPS Payments in India’s Digital Era

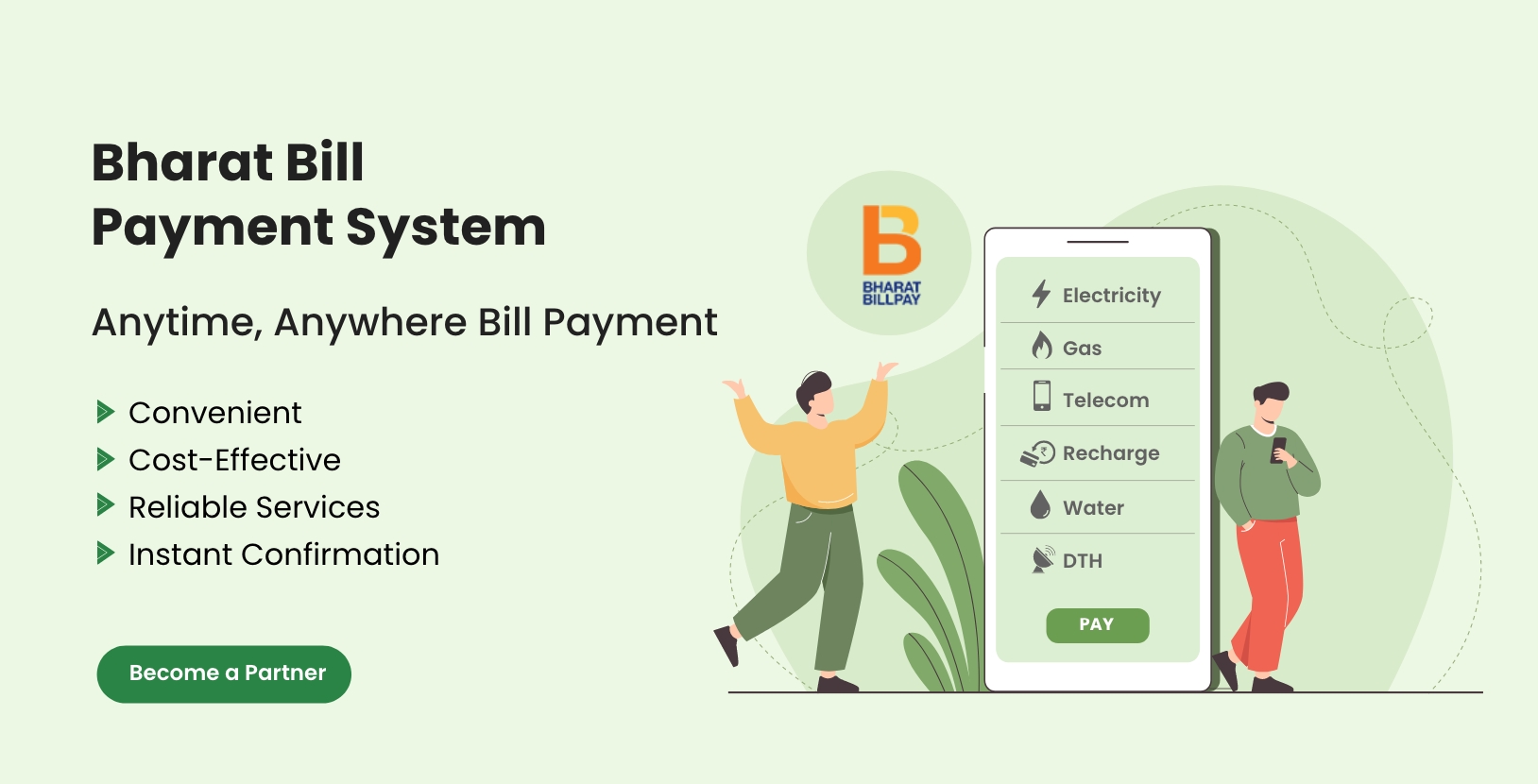

In recent years, India has achieved a significant milestone with its transformative journey from being a cash-dominated society to a cashless one. India’s digital payment revolution is a testament to India embracing a digital-first economy, making it a model case study to emulate in the world. Behind this revolution stands Bharat Bill Payment System. Since its incorporation in 2018, BBPS system has emerged as a vital feature in streamlining the bill payments. It has not just made the financial transactions fast, secure, and seamless, but has also empowered individuals, small businesses, and traders in driving this essential shift.

Understanding BBPS

Bharat Bill Payment System (BBPS) is an electronic bill payment system in India run by NPCI Bharat Bill Pay Limited (NBBL), a division of the National Payments Corporation of India (NPCI). Bharat Bill Payment Central Unit (BBPCU) works as the central hub and Bharat Bill Payment Operating Units (BBPOUs), authorised by the Reserve Bank of India, manage direct interactions with billers, customers and payment gateways. In order to facilitate bill payments and settlements, banks and other approved Payment Service Providers (PSPs) function as BBPOUs, with NBBL serving as the central entity.

Working seamlessly through a variety of channels for BBPS payments, such as Internet banking, mobile banking, mobile apps, BHIM-UPI, etc, the Bharat Bill Payment System (BBPS) offers customers an easily accessible and interoperable bill payment solution. It helps the citizens in paying their bills at any time and from any location. With a unified brand image and a tiered structure, the Bharat Bill Payment System works to establish a nationwide integrated bill payment system that provides consumers with accessible and interoperable bill payment services. It allows for a variety of payment methods and fast payment confirmation.

Is BBPS the same as UPI?

No, UPI and BBPS are not the same. On the face of it both of them are digital payment methods, but their functions are distinct. Where BBPS offers a single platform for all bill payments, UPI is a mobile app-based real-time payment system that facilitates direct bank-to-bank transactions.

How BBPS works: Step-wise process

Here is a step-by-step process of BBPS operations for the consumers –

- Bill Fetching: Customer first logs into a payment platform and chooses the biller by using a bill reference number to retrieve the bill.

- Payment Processing: Then, the customer selects the payment option that is convenient to them and validates the transaction after ensuring the bill contents are correct. After the payment is processed successfully, the BBPOU sends the payment details to the BBPCU and the customer’s account gets debited.

- Settlement: In order to guarantee prompt payment to the biller, the BBPCU oversees the settlement procedure between BBPOUs.

- Confirmation: The customer receives a printed receipt, an email, or an SMS confirming the payment.

The top benefits of BBPS

BBPS transforms bill payments into substantial gains and offers several business advantages –

- Businesses may handle all of their bill payments from a single location, thanks to the integrated platform of BBPS.

- Businesses can easily handle bill payments with the BBPS system and there is no need for major infrastructure changes.

- BBPS guarantees speedy money transfers, enabling businesses to get payments on time. This helps businesses manage their liquidity.

- Following strict security guidelines, BBPS ensures all transactions are safe and dependable.

While using BBPS, businesses get to choose from a range of payment options, such as UPI, mobile banking, and internet banking.

Subscribe to Our Newsletter

Keep in touch with our news & offers